Real estate

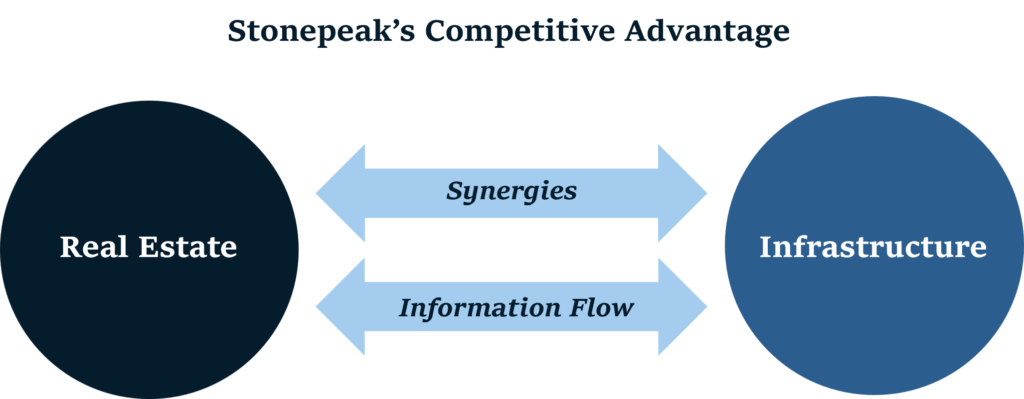

Stonepeak’s real estate team takes a focused approach to real estate investing by targeting opportunities at the intersection of infrastructure and real estate. We believe that our team’s experience coupled with advanced information from our broader global infrastructure portfolio provides for a differentiated strategy.

Supply Chain

Residential

Healthcare

Technology

Our approach to real estate in action

Meet the team

“We’re excited by the enormous opportunity set that exists within the intersection of real estate and infrastructure. Our real estate team’s deep industry relationships and years of shared working history combined with the Stonepeak platform are a powerful combination for investors.”

Phill is a Senior Managing Director and the Head of Real Estate at Stonepeak. Before joining Stonepeak, Phill was a Managing Director on the investment team at Blackstone where he helped launch Blackstone Infrastructure Partners after spending nearly a decade in Blackstone’s real estate group. Prior to Blackstone, Phill worked in Morgan Stanley’s real estate private equity and investment banking groups. Over the course of his career, Phill has played a key role in real estate and infrastructure investments representing nearly $100 billion of total enterprise value across the transportation, logistics, retail, gaming, healthcare, lodging, office, and residential sectors.

“Our ability to access Stonepeak’s infrastructure expertise and portfolio insights on a daily basis help us identify differentiated real estate investment opportunities where others may not be looking. We believe this is a true competitive advantage.”

Before joining Stonepeak, Connor was a Director at KKR in the Real Estate group. Prior to KKR, Connor worked in Real Estate investing roles at Cadre, Blackstone, and Morgan Stanley.

Andrew was a former Senior Managing Director and Head of Europe Asset Management for Blackstone’s Real Estate Group. Prior to leading the firm’s asset management team in Europe, Andrew worked for Blackstone in New York on the acquisitions team and was involved in analyzing and executing real estate equity investments across all property types.

Ralph was the founding President and CEO of LivCor, Blackstone’s multifamily portfolio company from 2013 until 2019, where he oversaw the aggregation, repositioning, and asset management of more than 70,000 units. Prior to joining LivCor, Ralph held senior roles at a number of leading real estate investment organizations, including Aimco (2007 – 2013), Hilton (2004 – 2007), and Catellus Development Corp (1995 – 2004) with responsibility for a variety of asset management and development-related activities.