Our portfolio

AGP Sustainable Real Assets

- HEADQUARTERS: Singapore

- INVESTMENT DATE: January 2024

AGP Sustainable Real Assets (“AGP”) is an investor, developer, and operator of sustainable real assets across renewable energy and sustainable infrastructure. By focusing on transformative infrastructure assets that make positive contributions to satisfying the United Nations’ Sustainable Development Goals, AGP seeks to generate a positive impact for people and the environment. AGP has delivered or is presently developing, constructing, or operating a global portfolio spanning renewable energy assets, modern logistics warehousing, data centers, and community housing. Stonepeak and AGP formed a strategic investment partnership to help accelerate the growth of AGP’s portfolio across new markets and business verticals.

Akumin

- HEADQUARTERS: Plantation, FL

- INVESTMENT DATE: September 2021

Akumin is a leading national provider of radiology and oncology solutions to patients in the U.S. and a partner of choice for U.S. hospitals, health systems and physician groups. Akumin provides freestanding, fixed-site outpatient diagnostic imaging services through a network of more than 145 fixed-site centers nationwide, and outpatient radiology and oncology solutions to approximately 1,000 hospitals and health systems in 47 states.

Arvida

- HEADQUARTERS: Auckland, New Zealand

- INVESTMENT DATE: November 2024

Arvida is one of New Zealand’s largest operators of retirement villages and aged care facilities, which provide essential services for the region’s growing aging population. With more than 30 retirement villages located nationally, Arvida provides a range of living and lifestyle options, from independent living to full rest home, hospital, and dementia-level care.

Asia Energy Storage Platform

- HEADQUARTERS: Various

- INVESTMENT DATE: May 2024

The Asia Energy Storage Platform was created in 2024 by Stonepeak and CHC Energy, a leading battery energy storage system (BESS) developer based in Singapore. The platform is dedicated to the development, construction, and operation of energy storage projects in Asia, with an initial focus on Japan. The platform’s assets include energy storage assets located in Japan, underpinned by 20-year fixed revenue capacity market contracts as part of the Japanese government’s Long-term Decarbonization Auction. Going forward, Stonepeak expects the platform to pursue additional BESS projects both within Japan and in other Asian markets to facilitate regional carbon neutrality goals while supporting grid stability and reliability.

Astound Broadband

- HEADQUARTERS: Princeton, NJ

- INVESTMENT DATE: August 2021

Astound Broadband is the sixth largest cable provider in the United States, providing award-winning high-speed internet, broadband communications solutions, TV, phone services, and fiber optic solutions for residential and business customers across the United States. Astound comprises RCN Telecom Services, LLC, Grande Communications, Wave Broadband, and enTouch and serves Chicago, Indiana, Eastern Pennsylvania, Massachusetts, New York City, Maryland, Washington, D.C., Texas, and regions throughout California, Oregon, and Washington.

ATSG

- HEADQUARTERS: Wilmington, Ohio

- INVESTMENT DATE: April 2025

Air Transport Services Group (ATSG) is a premier provider of aircraft leasing, cargo, and passenger air transportation solutions for both domestic and international air carriers, as well as companies seeking outsourced airlift services. It is the global leader in freighter aircraft leasing, with a fleet that includes Boeing 767, Airbus A321, and Airbus A330 converted freighters. Complementary services from ATSG’s other subsidiaries allow the integration of aircraft maintenance, airport ground services, and material handling equipment engineering and service.

Carlsbad Desalination Plant / Orion Water Partners

- HEADQUARTERS: Carlsbad, CA

- INVESTMENT DATE: December 2012

Orion Water Partners is a joint venture with Poseidon Resources that was formed to construct, own, and operate the Carlsbad Desalination Plant, a 50 million gallon-per-day seawater desalination plant providing high quality water to San Diego County under a long‐term take‐or‐pay contract with the San Diego County Water Authority. The plant has been delivering water to the businesses and residents of San Diego County since December 2015 and is the largest desalination plant of its kind in the United States. The Carlsbad Dealination Plant was sold to Aberdeen Standard Investments in May 2019.

Casper Crude to Rail

- HEADQUARTERS: Houston, TX

- INVESTMENT DATE: October 2013

Casper Crude to Rail LLC is a joint venture with Cogent Energy Solutions LLC and Granite Peak Development to jointly develop, construct and operate crude oil rail infrastructure in Casper, Wyoming. Casper Crude to Rail LLC was sold to USD Partners in October 2015.

Cellnex Nordics

- HEADQUARTERS: Stockholm, Sweden and Copenhagen, Denmark

- INVESTMENT DATE: November 2023

Cellnex Nordics, the Swedish and Danish operations of Cellnex Telecom (BME:CLNX), Europe’s largest operator of wireless telecommunications infrastructure, is the leading independent provider of colocation services for mobile network operators in the region. The Cellnex Nordics network totals more than 5,100 sites, including rooftop sites, ground-based towers, and other telecom structures, and has commitments and options to build and operate approximately 1,950 additional sites across the region. Stonepeak owns a 49 percent interest in Cellnex Nordics with Cellnex holding the remaining 51 percent.

Cirion Technologies

- HEADQUARTERS: Miami, Florida

- INVESTMENT DATE: August 2022

Cirion Technologies is a leading digital infrastructure provider, offering a comprehensive suite of fiber network, connectivity, colocation, cloud infrastructure, and communication and collaboration solutions. Cirion owns and operates a facilities-based network and data center portfolio, with extensive coverage spanning across the Latin America region. The company has more than 91,000 kilometers of metro, terrestrial and subsea fiber routes, and 18 cable landing stations supporting 5 global subsea systems, providing direct connectivity between key Latin American metros and to the United States. Cirion operates one of the most interconnected data center platforms in Latin America, comprising 18 owned data centers.

Clean Energy

- HEADQUARTERS: Newport Beach, California

- INVESTMENT DATE: December 2023

Clean Energy Fuels Corp. (NASDAQ: CLNE) is the largest provider of renewable natural gas (RNG), a sustainable fuel derived by capturing methane from organic waste, for the transportation market in the U.S. With a growing portfolio of RNG production facilities and an extensive network of more than 600 fueling stations across North America, Clean Energy helps thousands of vehicles, including hundreds of fleets of heavy-duty trucks, easily and affordably reduce their greenhouse gas emissions every day.

Coastal Virginia Offshore Wind

- INVESTMENT DATE: October 2024

Coastal Virginia Offshore Wind (CVOW) is a 2.6-gigawatt offshore wind project located approximately 27 miles off the coast of Virginia Beach, Virginia, and the largest offshore wind farm currently under construction in the United States. Once fully constructed in late 2026, CVOW is expected to generate enough clean, renewable energy to power up to 660,000 homes. Stonepeak acquired a 50% noncontrolling interest in the project through the formation of an offshore wind partnership with Dominion Energy (NYSE: D).

Cologix

- HEADQUARTERS: Denver, CO

- INVESTMENT DATE: March 2017

Cologix provides carrier and cloud neutral hyperscale edge data centers and services across North America. Cologix is the interconnection hub for cloud service providers, carriers and a rich ecosystem of partners who want to deploy applications at the very edge across Canada and the U.S. With a growing portfolio of next generation facilities that meet the unique requirements for hyperscale growth with deep connectivity, Cologix offers massive scale and tailor-made data center solutions to accelerate customers’ digital transformation. Cologix provides its interconnection solutions in 45+ sites across 12 markets.

CoreSite

- HEADQUARTERS: Denver, Colorado

- INVESTMENT DATE: August 2022

CoreSite, an American Tower company (NYSE: AMT), is a data center platform that provides hybrid IT solutions that empower enterprises, cloud, network, and IT service providers to monetize and future-proof their digital business. Its highly interconnected data center campuses offer a native digital supply chain featuring direct cloud onramps to enable its customers to build customized hybrid IT infrastructure and accelerate digital transformation. For more than 20 years, CoreSite’s team of technical experts have partnered with customers to optimize operations, elevate customer experience, dynamically scale, and leverage data to gain competitive edge.

DELTA Fiber

- HEADQUARTERS: Schiedam, Netherlands

- INVESTMENT DATE: April 2022

DELTA Fiber is a leading owner and operator of fixed telecom infrastructure in the Netherlands, providing broadband, TV, telephone and mobile services to B2C and B2B customers under the brands DELTA and Caiway over a predominantly fiber network. DELTA Fiber is one of the fastest growing fiber companies in the Netherlands with over 1.7 million addresses throughout the Netherlands already connected to the DELTA Fiber network. DELTA Fiber’s ambition is to provide as many households and companies as possible with access to fast internet.

Digital Edge

- HEADQUARTERS: Singapore

- INVESTMENT DATE: August 2020

Digital Edge is a trusted and forward-looking data center platform company, established to transform digital infrastructure in Asia. Headquartered in Singapore, Digital Edge builds and operates state-of-the-art, energy-efficient data centers rich with connectivity options, and aims to bring new colocation and interconnect options to the Asian market, making infrastructure deployment in the region easy, efficient, and economical. Digital Edge was founded by a seasoned senior management team with decades of industry experience and an established track record of value creation in the data center, cloud and telecommunications industries in the Asia-Pacific region.

Dominion Midstream Partners LP

- HEADQUARTERS: Richmond, VA

- INVESTMENT DATE: December 2016

Dominion Midstream Partners LP (NYSE: DM) is a master limited partnership formed by the investment-grade utility Dominion Resources Inc. to grow a portfolio of natural gas terminaling, processing, storage, transportation, and related assets. In January 2019, Stonepeak realized its investment in Dominion.

Emergent Cold LatAm

- HEADQUARTERS: Sao Paulo, Brazil

- INVESTMENT DATE: July 2021

Emergent Cold LatAm is building the highest quality cold storage network to provide integrated, end-to-end temperature-controlled logistics solutions to customers throughout Latin America. Emergent Cold was founded to fill a need for modern cold-chain solutions within the market and to serve the increasing demand from domestic and global trade customers.

Equalbase

- HEADQUARTERS: Singapore

- INVESTMENT DATE: September 2022

Equalbase is an integrated development and management platform focused on the logistics sector across Asia Pacific. The platform is led by a team with more than 40 years of industry experience and is headquartered in Singapore. Stonepeak’s strategic investment partnership with Equalbase is intended to facilitate the development and acquisition of high-quality modern logistics facilities throughout Asia Pacific and accelerate the growth of the Equalbase platform as a leading sustainable developer and specialist manager in the region.

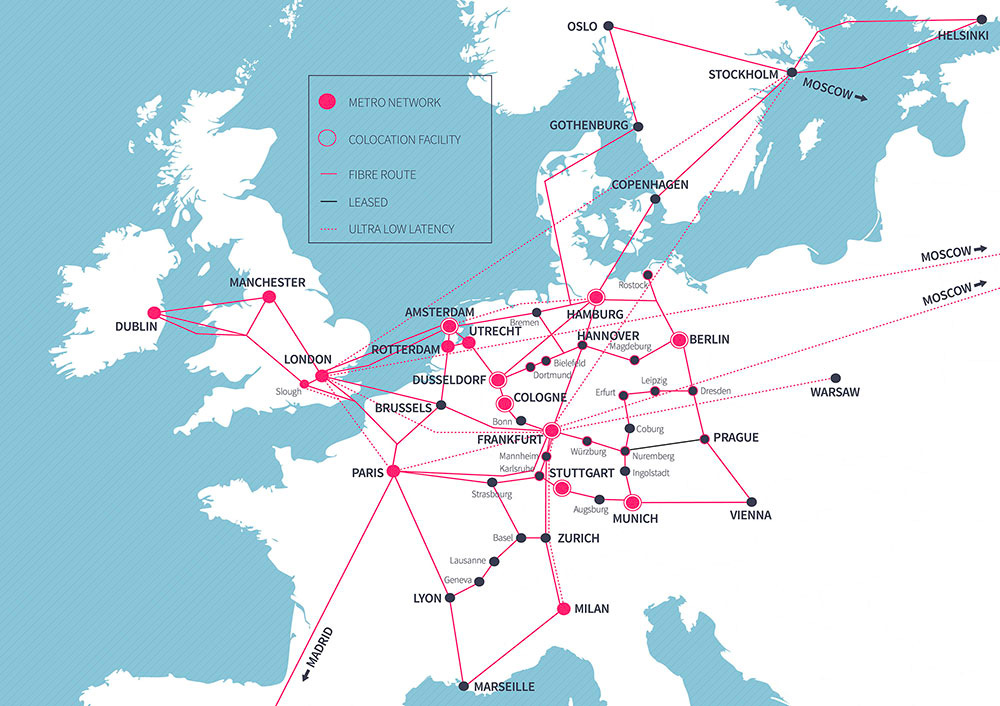

euNetworks

- HEADQUARTERS: London, UK

- INVESTMENT DATE: January 2018

euNetworks is a bandwidth infrastructure company that owns and operates 18 dense fiber based metropolitan networks in Western Europe, connected with a high-capacity intercity backbone covering 53 cities in 17 countries. euNetworks leads the market in data center connectivity, directly connecting over 550 in Europe today, and is also a leading cloud connectivity provider, directly connecting to all key cloud platforms with access to additional platforms.

Evolve Transition Infrastructure LP

- HEADQUARTERS: Houston, TX

- INVESTMENT DATE: October 2015

Evolve Transition Infrastructure LP is a limited partnership formed in 2005 focused on the acquisition, development and ownership of infrastructure critical to the transition of energy supply to lower carbon sources. Evolve owns natural gas gathering systems, pipelines, and processing facilities in South Texas and continue to pursue energy transition infrastructure opportunities.

Extenet

- HEADQUARTERS: Frisco, TX

- INVESTMENT DATE: November 2015

Extenet is a leading provider of converged communications infrastructure and services addressing outdoor and in-building wireless, fiber and other advanced connectivity needs of its customers. Extenet customers include mobile network operators (MNOs), real estate owners, property managers, wholesale carriers, enterprises, and municipalities.

GeelongPort

- HEADQUARTERS: North Geelong, Victoria, Australia

- INVESTMENT DATE: April 2023

GeelongPort is Victoria’s second largest port located approximately 75 kilometers southwest of Melbourne within Victoria’s largest regional city, Geelong. It is a diversified landlord port and a major driver of Victoria’s economy, managing over A$7 billion of trade – it handles close to 12 million tons of cargo and more than 600 vessel visits each year – and supporting more than 1,800 jobs across the state. The Port comprises 15 berths over two primary precincts, Corio Quay and Lascelles Wharf, providing land, infrastructure, and services to facilitate trade for some of Victoria’s largest businesses. Stonepeak manages a majority 70 percent interest in GeelongPort alongside Spirit Super who has a 30 percent stake.

GTA

- HEADQUARTERS: Tamuning, Guam

- INVESTMENT DATE: January 2024

TeleGuam Holdings (“GTA”) is a leading digital infrastructure provider in Guam and the island’s longest-serving telecom provider, having been in operation for more than 70 years. The business offers cable landing stations and data center facilities interconnected by a dense, next-generation fiber network, in addition to quad-play broadband, wireless, telephony, and video solutions. Stonepeak is an investor in GTA alongside majority owner Huntsman Family Investments.

Hygo Energy Transition

- HEADQUARTERS: Hamilton, Bermuda

- INVESTMENT DATE: July 2016

Hygo Energy Transition is a 50-50 joint venture with Golar LNG Limited that provides integrated downstream LNG solutions to underserved markets by delivering low cost, environmentally sound energy alternatives to consumers around the world. Hygo’s business includes its network of existing and development stage marine LNG import terminals, its ownership of interests in existing and development stage large-scale power plants backed by high quality offtakers, and the downstream distribution of LNG from its terminals via marine and onshore logistics to major demand centers. Hygo was sold to New Fortress Energy in April 2021.

Inspired Education Group

- HEADQUARTERS: London, UK

- INVESTMENT DATE: May 2022

Inspired Education Group is the leading global group of premium schools educating more than 90,000 students in over 118 schools across more than 24 countries. All Inspired schools are individually developed and designed in response to their environment and location, delivering an excellent education to their respective communities. Inspired offers a fresh and contemporary approach to education by re-evaluating traditional teaching methods and curriculums, and creating a more dynamic, relevant and powerful model reflecting current attitudes. Inspired schools nurture the unique individuality, talent and self-assurance of each student, equipping them to take on the world with the skills and confidence to ensure success.

Intrado

- HEADQUARTERS: Longmont, Colorado

- INVESTMENT DATE: January 2023

Intrado is a market-leading provider of critical public safety communications infrastructure. For over 45 years, Intrado has provided the foundational backbone of 911 in North America, connecting citizens to 911 services over a reliable, secure, standards-based network that serves more than 3 million wireless sites, 200 million telephone numbers, and 6,000+ public safety answering point seats. Intrado’s technology-driven solutions are designed to be robust, resilient, intuitive, and insightful, ensuring that emergency responders can quickly and effectively provide assistance when it is needed most. Intrado’s mission is to save lives by improving public safety outcomes.

Ironclad Energy

- HEADQUARTERS: Lombard, IL

- INVESTMENT DATE: September 2016

Ironclad Energy Partners is a joint venture formed with power industry veterans that acquires, develops, and makes additional capital investments in middle-market energy generation facilities. Ironclad’s projects are critical for its customers and provide cost-efficient, reliable, and sustainable energy including power, steam, chilling, water, compressed air, and other critical utilities. Stonepeak realized its investment in Ironclad in May 2021.

KAPS

- HEADQUARTERS: Alberta, Canada

- INVESTMENT DATE: April 2023

KAPS is a Canadian natural gas liquids pipeline system connecting Northwest Alberta to energy hubs in Edmonton and Fort Saskatchewan. Stonepeak owns 50 percent of KAPS alongside Keyera Corp. (TSX: KEY) who owns the remaining 50 percent and operates the asset. The KAPS system consists of an approximately 560 kilometer dual pipeline system linking Montney and Duvernay production in Western Canada to fractionation and logistics assets in Fort Saskatchewan, including Keyera’s Fort Saskatchewan complex, and is anchored by secure, long-term, take-or-pay revenues with a broad customer base that includes meaningful commitments from investment grade counterparties.

Lineage

- HEADQUARTERS: Novi, MI

- INVESTMENT DATE: May 2018

Lineage (Nasdaq: LINE) is one of the world’s leading temperature-controlled industrial REIT and logistics solutions providers. Lineage has a global network of over 485 strategically located facilities totaling over 3.1 billion cubic feet of capacity, which spans 17 countries across North America, Europe, and Asia-Pacific. Lineage’s industry-leading expertise in end-to-end logistical solutions, its unrivaled real estate network, and development and deployment of innovative technology help increase distribution efficiency, advance sustainability, minimize supply chain waste, and most importantly, as a Visionary Partner of Feeding America, help feed the world.

LOGISTEC

- HEADQUARTERS: Montreal, Quebec

- INVESTMENT DATE: January 2024

LOGISTEC Corporation is a leading provider of specialized services to the marine community and industrial companies, handling bulk, break-bulk and container cargo in 62 ports and 87 terminals located in North America. LOGISTEC also offers marine transportation services geared primarily to the Arctic coastal trade as well as marine agency services to shipowners and operators serving the Canadian market. Additionally, the company provides a range of environmental services, including renewal of underground water mains as well as site remediation and decommissioning, to industrial, municipal, and other governmental customers. Stonepeak is an investor in LOGISTEC alongside Blue Wolf Capital Partners.

Longview Infrastructure

- HEADQUARTERS: Saint Louis, MO

- INVESTMENT DATE: March 2025

Longview Infrastructure collaborates with Independent System Operators (ISOs), utilities, and communities to develop, construct, finance, and operate electric transmission projects in the United States. Founded by former LS Power and NextEra Energy Transmission executives, the platform is committed to managing critical transmission infrastructure to support growing demand for electricity and grid reliability.

Maas Energy Works

- HEADQUARTERS: Redding, California

- INVESTMENT DATE: November 2022

Maas Energy Works is a leading renewable natural gas developer in the United States. MEW specializes in the development, ownership, and operation of anaerobic digesters located on dairy farms, with 70+ digesters in operation and another 50+ in construction and development.

Madison Energy Investments

- HEADQUARTERS: Vienna, VA

- INVESTMENT DATE: March 2019

Madison Energy Investments LLC is a platform that develops, owns, and operates distributed solar generation assets within the commercial and industrial and small utility-scale sectors across North America. Stonepeak realized its investment in Madison in February 2023.

Montera Infrastructure

- INVESTMENT DATE: April 2025

Montera Infrastructure is a North American hyperscale-focused data center company. Montera was created to develop and operate turnkey, build-to-suit data centers to support the rapid growth of cloud computing and AI inferencing workloads for hyperscale customers in Tier I and Tier II markets across North America. The Montera team brings decades of experience in infrastructure development and operations, focusing on accelerating growth and setting new benchmarks for performance and reliability.

MPLX LP

- HEADQUARTERS: Findlay, OH

- INVESTMENT DATE: May 2016

MPLX LP (NYSE:MPLX) is a diversified, large-cap master limited partnership formed by Marathon Petroleum Corporation that owns and operates midstream energy infrastructure and logistics assets, and provides fuels distribution services. MPLX’s assets include a network of crude oil and refined product pipelines; an inland marine business; light-product terminals; storage caverns; refinery tanks, docks, loading racks, and associated piping; and crude and light-product marine terminals. MPLX also owns crude oil and natural gas gathering systems and pipelines as well as natural gas and NGL processing and fractionation facilities in key U.S. supply basins. Stonepeak realized its investment in MPLX in May 2024.

NorthStar Renewable Power Corporation

- HEADQUARTERS: New York, NY

- INVESTMENT DATE: August 2012

Northstar owns and operates a portfolio of ground‐mount solar power generation facilities in Ontario, Canada under the province’s Feed‐In‐Tariff (“FIT”) regime. Ontario’s FIT program is North America’s first comprehensive guaranteed pricing structure for renewable electricity production. It includes standardized program rules, prices and contracts for developing a qualifying renewable energy projects. Each project sells power to the Ontario Power Authority under long term, fixed price power purchase agreements.

In August 2012 Northstar acquired Stone Mills Solar Park LP. Northstar was sold to DIF Infrastructure III in August 2014.

Ørsted U.S. Onshore Wind Portfolio Partnership

- INVESTMENT DATE: May 2024

In 2024, Stonepeak acquired an equity ownership stake in a portfolio of four U.S. onshore wind farms from global renewable developer Ørsted. The portfolio has a total capacity of 957 MW across three different markets: the Electric Reliability Council of Texas (ERCOT), Midcontinent Independent System Operator (MISO), and Southwest Power Pool (SPP). It includes the Ford Ridge Wind project in Illinois, the Helena Wind and Western Trail Wind projects in Texas, and the Sunflower Wind project in Kansas, all of which were operational at the time of signing with power purchase agreements in place.

Oryx Midstream

- HEADQUARTERS: Midland, TX

- INVESTMENT DATE: April 2019

Oryx Midstream is a leading private midstream company. In October 2021, Oryx merged its assets, operations, and commercial activities in the Permian Basin into a newly formed joint venture with Plains All American, Plains Oryx Permian Basin. Through its role on the partnership’s joint operating committee and board, Oryx provides critical oversight on material joint venture operating and commercial decisions, and remains dedicated to providing producers with solutions and flexibility through a full suite of midstream services.

Paradigm Energy Partners

- HEADQUARTERS: Dallas, TX

- INVESTMENT DATE: March 2014

Paradigm Energy Partners is an energy management company focused on developing, constructing, and operating midstream assets in the Bakken Shale in North Dakota and the Eagle Ford in South Texas. In September 2018, Paradigm was sold to affiliates of Ares EIF.

Peak Energy

- HEADQUARTERS: Singapore

- INVESTMENT DATE: August 2020

Peak Energy is a platform dedicated to the development, ownership and operation of renewable assets in Asia with a focus on Japan, South Korea, and Taiwan, as well as opportunities in Southeast Asia. Peak Energy is led by an experienced team that manages the Company’s energy assets from origination and development through to operations and decommissioning with modern technologies and industry best practices.

Pelican Pipeline

- HEADQUARTERS: Austin, TX

- INVESTMENT DATE: October 2024

The Pelican Pipeline is a new-build natural gas pipeline being developed by WhiteWater Midstream. The pipeline is designed to transport up to 1.75 billion cubic feet per day (Bcf/d) of natural gas through approximately 170 miles of 36-inch pipeline from Williams, Louisiana in the Haynesville Basin to the Gillis Hub near Louisiana’s Gulf Coast. Poised to benefit from near-term volume growth in the Haynesville Basin and significant demand-pull from incremental LNG exports, the pipeline is positioned to play an important role in providing secure, reliable, and affordable energy amid the global energy transition.

Philippines Tower JVCo

- HEADQUARTERS: Manila, Philippines

- INVESTMENT DATE: August 2022

The Philippines Tower JVCo is a holding company comprising MIESCOR Infrastructure Development Corporation (MIDC) and Phil-Tower Consortium Inc. (PTCI). The company builds, owns, and operates mobile towers and other wireless infrastructure assets and leases access to these assets to mobile network operators and other telecommunication companies in the Philippines. The JVCo is backed by Stonepeak, Meralco Industrial Engineering Services Corporation (MIESCOR), Macquarie Capital, and Global Network Inc.

Phillips 66 Partners LP

- HEADQUARTERS: Houston, TX

- INVESTMENT DATE: October 2017

Phillips 66 Partners LP (NYSE: PSXP) is a growth-oriented master limited partnership formed by Phillips 66 to own, operate, develop, and acquire primarily fee-based crude oil, refined petroleum products and natural gas liquids pipelines and terminals, and other transportation and midstream assets. Stonepeak realized its investment in Phillips 66 in March 2022.

Plains All American Pipeline LP

- HEADQUARTERS: Houston, TX

- INVESTMENT DATE: January 2016

Plains All American Pipeline LP (NYSE: PAA) is a publicly traded master limited partnership that owns and operates midstream energy infrastructure and provides logistics services for crude oil, natural gas liquids (NGL) and natural gas. They own an extensive network of pipeline transportation, terminalling, storage and gathering assets in key crude oil and NGL producing basins and transportation corridors and at major market hubs in the United States and Canada. Stonepeak realized its investment in Plains All American in August 2024.

Rinchem

- HEADQUARTERS: Albuquerque, NM

- INVESTMENT DATE: March 2022

Rinchem Company, Inc. is a leader in end-to-end specialty chemical logistics management, with a widespread, global network of chemical and gas distribution centers. The company sets the standard in creating and managing safe and efficient supply chains for high purity, pre-packaged chemicals and gases. Rinchem applies four decades of expertise, industry thought leadership, and logistics transparency in order to provide the most reliable, efficient, and cost-effective solutions for its customers. The primary industries that Rinchem serves include pharmaceutical, biotech, semiconductor, and aerospace.

Seapeak / Stonepeak Marine Platform

- HEADQUARTERS: Hamilton, Bermuda

- INVESTMENT DATE: January 2022

Seapeak – formerly Teekay LNG – is a diverse, multicultural and global group of experienced seafarers and operational and commercial leaders. With ownership interests in 90 vessels and a regasification terminal, Seapeak is a global leader, with one of the largest fleets of Liquefied Natural Gas (LNG) and Liquefied Petroleum Gas (LPG) vessels. The company is committed to providing the highest level of operational performance for its customers, and always safety first, no compromises.

Stonepeak Aviation Platform

- HEADQUARTERS: United States

- INVESTMENT DATE: May 2021

Stonepeak Aviation Platform is a diversified, independent aviation investment platform created in partnership with the highly experienced, sector-specialty management team of Bellinger Asset Management. The platform seeks to deploy capital opportunistically and strategically across the aviation sector including sale leasebacks, secondary aircraft acquisitions, and aviation credit or structured equity opportunities.

Stonepeak Infrastructure Logistics Platform

- HEADQUARTERS: United States

- INVESTMENT DATE: June 2021

Stonepeak Infrastructure Logistics Platform is a diversified, independent supply chain infrastructure logistics platform that seeks to invest in strategically located, defensive, long-term contracted assets.

Stonepeak Island Transition

- HEADQUARTERS: Various

- INVESTMENT DATE: June 2022

Stonepeak created the Stonepeak Island Transition platform in 2022 to enhance access to sustainable, reliable, and affordable electricity generation across the Caribbean and Central America through investment in renewable energy solutions. The platform’s assets include a 27MWdc operating solar farm located in Puerto Rico underpinned by a 25-year power purchase and operating agreement with PREPA and two structured investments in a Caribbean- and Latin America-focused independent power producer looking to transition its legacy portfolio of thermal generation as part of its aggressive decarbonization strategy.

Stonepeak New England Power

- HEADQUARTERS: Massachusetts (Canal I, II, and III) & Maine (Bucksport)

- INVESTMENT DATE: June 2018 (Bucksport follow-on 2019)

Stonepeak New England Power is one of the largest power generation portfolios in New England. The portfolio includes the Canal I, II, and III and Bucksport power generation assets, which provide a total of more than 1,600 MW of aggregate generating capacity located in ISO New England. Stonepeak New England Power was sold to JERA Americas in May 2022.

Synera Renewable Energy Co., LTD.

- HEADQUARTERS: Taipei, Taiwan

- INVESTMENT DATE: October 2019

Synera Renewable Energy Co., LTD. is a leading offshore wind developer and operator based in Taiwan. Synera entered into the offshore wind business in 2012 and has built a reputation as a reliable partner in a number of areas including environmental monitoring, governmental permits, risk reduction, asset management, and wind farm maintenance and operation. Synera has developed and constructed Formosa 1, a 128 MW offshore wind farm, and Formosa 2, a 376 MW offshore wind farm.

Targa Resources Corp.

- HEADQUARTERS: Houston, TX

- INVESTMENT DATE: March 2016

Targa Resources Corp. (NYSE: TRGP) is a leading provider of midstream services and is one of the largest independent midstream infrastructure companies in North America. Targa owns, operates, acquires, and develops a diversified portfolio of complementary midstream infrastructure assets and its operations are critical to the efficient, safe and reliable delivery of energy across the United States and increasingly to the world. Targa’s assets connect natural gas and NGLs to domestic and international markets with growing demand for cleaner fuels and feedstocks. Stonepeak realized its investment in Targa in May 2022.

Targa Resources Corp. – JV Co

- HEADQUARTERS: Houston, TX

- INVESTMENT DATE: February 2018

Targa Resources Corp. JV Co (Targa JV Co) is a joint venture with Targa Resources Corp. (NYSE: TRGP), a leading provider of midstream services and one of the largest independent midstream infrastructure companies in North America. Targa owns, operates, acquires, and develops a diversified portfolio of complementary midstream infrastructure assets and its operations are critical to the efficient, safe and reliable delivery of energy across the United States and increasingly to the world. Targa JV Co is specifically focused on building several high-quality midstream infrastructure assets. Stonepeak realized its investment in Targa JV Co in January 2022.

TerraWind Renewables

- HEADQUARTERS: Japan

- INVESTMENT DATE: March 2024

TerraWind Renewables is a platform focused on the development of onshore wind projects in Japan and across the Asia-Pacific region. The joint platform was established in 2024 in partnership with Japanese renewable energy company Shizen Energy, which focuses on the development, financing, and management of renewable energy power plants using solar power, wind power, hydroelectric power, and biomass. Stonepeak owns an 80% interest in TerraWind, with Shizen owning the remaining 20% interest in the business.

Textainer

- HEADQUARTERS: Hamilton, Bermuda

- INVESTMENT DATE: March 2024

Textainer is one of the world’s largest lessors of intermodal containers, with more than 4.5 million TEU in its owned and managed fleet. Textainer’s fleet consists of standard dry freight, refrigerated intermodal containers, and dry freight specials. Operating via a network of approximately 400 independent depots worldwide, the company leases containers to approximately 200 customers, including many of the world’s leading international shipping lines. Textainer also leases tank containers through its relationship with Trifleet and is a major trader and reseller of used containers.

The AA

- HEADQUARTERS: Basingstoke, UK

- INVESTMENT DATE: July 2024

The AA is the leading provider of roadside assistance in the UK, with a nationwide network of patrols and garages serving 14.5 million members. The company also provides insurance and a range of other services across the driving category. Stonepeak invested in The AA, an essential component of the UK’s transportation system, through a combination of common and preferred equity and now owns a minority interest in the company alongside its majority shareholders, Warburg Pincus and TowerBrook.

The Cosmopolitan of Las Vegas PropCo

- HEADQUARTERS: Las Vegas, NV

- INVESTMENT DATE: May 2022

The Cosmopolitan of Las Vegas PropCo comprises the real estate assets of The Cosmopolitan of Las Vegas, an iconic and strategically located Las Vegas resort and mission critical property to MGM Resorts International (NYSE: MGM), an S&P 500 global entertainment company that owns the operations of The Cosmopolitan. The PropCo, which is backed by a partnership between Stonepeak controlled vehicles and Blackstone Real Estate Income Trust, maintains a long-term net lease with MGM.

Tidewater Holdings

- HEADQUARTERS: Vancouver, WA

- INVESTMENT DATE: December 2012

Tidewater Holdings is the pre‐eminent barge and terminal operator on the Columbia‐Snake river system in the Pacific Northwest. Headquartered in Vancouver, WA, the company’s operations extend from the inland Port of Lewiston, ID to the Port of Astoria, OR on the Pacific Coast. In December 2018, Tidewater was sold to an investor group led by Upper Bay Infrastructure Partners.

TRAC Intermodal

- HEADQUARTERS: Princeton, NJ

- INVESTMENT DATE: March 2020

TRAC Intermodal is North America’s leading marine chassis pool manager and equipment provider with 11 pools under management across the U.S. TRAC has the largest fleet of marine and specialty chassis in North America and operates an extensive network of facilities. TRAC’s subsidiaries offer emergency fleet roadside assistance through FYX, and maintenance and repair services as well as storage and parking solutions through TRAC Services.

Venture Global Calcasieu Pass

- HEADQUARTERS: Southwest Louisiana + Washington DC

- INVESTMENT DATE: August 2019

Venture Global Calcasieu Pass is operating an LNG export facility located at the mouth of the Calcasieu Ship Channel in Southwest Louisiana. Calcasieu Pass is majority owned and operated by Venture Global LNG (NYSE: VG), a long-term, low-cost provider of American-produced liquified natural gas. The project site features deep-water access, proximity to plentiful gas supplies and ease of transport for buyers.

Vertical Bridge

- HEADQUARTERS: Boca Raton, FL

- INVESTMENT DATE: November 2014

Vertical Bridge is a private owner and manager of wireless communication infrastructure in the United States with a deep backlog of Build-to-Suit towers and M&A opportunities. Vertical Bridge primarily leases space to telecommunications carriers and other users of wireless technology. Stonepeak realized its investment in Vertical Bridge in August 2021.

West Texas Gas

- HEADQUARTERS: Midland, TX

- INVESTMENT DATE: September 2021

West Texas Gas (WTG) has core businesses in natural gas distribution operations, natural gas transmission services, gas gathering and processing, and natural gas liquids transmission services. Stonepeak sold its interest in WTG Midstream to Energy Transfer (NYSE: ET) in May 2024, and fully realized its investment in WTG in October 2024.

Whistler Pipeline

- HEADQUARTERS: Austin, TX

- INVESTMENT DATE: June 2019

Whistler Pipeline is a joint venture with MPLX LP, WhiteWater Midstream, LLC and West Texas Gas, Inc. that develops, owns, and operates a long-distance natural gas pipeline from West Texas to the Gulf Coast constructed to provide relief to Permian Basin natural gas takeaway constraints. The Whistler project is underpinned by long term, contractual minimum volume agreements from investment grade customers in the Permian Basin. Stonepeak realized its investment in Whistler in February 2023.

Xplore Inc.

- HEADQUARTERS: Woodstock, New Brunswick

- INVESTMENT DATE: June 2020

Xplore Inc. is one of Canada’s leading rural-focused broadband service providers. For over a decade, Xplore has been providing innovative fixed and mobile broadband solutions to rural customers at work, home, and play across Canada. Xplore offers voice and data communication services through its unique fiber wireless and satellite network that connects Canadians to what matters.

Portfolio includes all current realized and unrealized (including partially realized) investments made by Stonepeak funds.